Check list to select a payment processing software (EIPP)

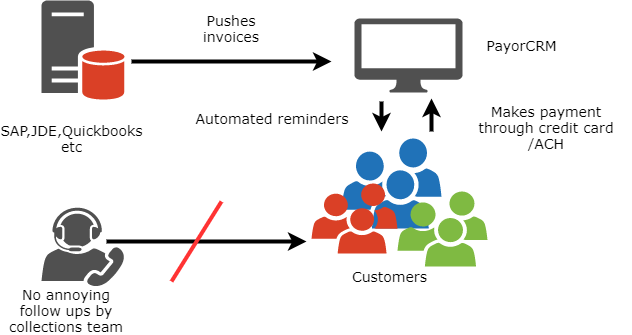

Selecting a payment processing software is an important decision to make as the time and effort spent in setting up the system should provide long-term benefits to help to scale up the accounts receivable division of any organizations.As the organization grows by leaps and bounds by adding more customers and increased revenue, the accounts receivable department needs to grow to be able to catch up with the increased overheads.Automation becomes a boon in such situations as most of the repeating non-value adding tasks can be done away with automation and the company can focus on the most important of activities.

The payment processing software check list provides with the list of most common requirements we have seen over the years as being considered most valuable for our clients.The requirements may vary from client to client or industry to industry but the below may be taken as a checklist to start off the initial research in finding the perfect EIPP software

Connects to multiple ERP systems – Can connect to multiple ERP systems. Read more

Customer Management – Manages new user sign-ups, reset password requests

Customer Portal – Provides a self-service customer portal that lets your customers manage their subscription by themselves

Invoicing – Sends automatic, unambiguous invoices to your customers when they sign up on multiple days before and after invoice due dates

Pricing Plan Management – Lets you make changes in your plans while still being able to grandfather existing customers, add new plans, create/edit add-ons, and so on, without any hassles or second thoughts

Failed Transaction Management – Tracks failed payments and informs the customers about them. Also manages fraudulent/expired credit cards and transaction failures etc

Discounts – Ensures the payable amount is in line with the discounts you are providing according to payment date

Customer Messaging for Billing and Error Handling – Records billing errors and automatically sends emails to customers at the right time

Support for Multiple Payment Gateways and currencies – Supports multiple payment methods (ACH, CPA, Swift, Same day ACH etc ) and is not limited to credit cards /PayPal for payments

User Roles – Offers user role levels to limit who can do what on the application

Third Party Integration – Provides the option to integrate with third-party applications

Event Triggers and Webhooks – Notifies you when prespecified events occur

Email Automation -Takes care of email automation by default depending on what timing has been proven to be effective in improving collections based on past data and industry standards

Hosted Payment API/page – Provides an API in case you generate invoices in your company’s e-commerce portal

Data Portability – Permits you to export your customer invoices, payment status, customer details etc

Also published on Medium.