Steps to Integrate Netsuite with Stripe

NetSuite lacks a built-in feature for sending invoices to customers with the ability to make payments through ACH transfers or credit card payment links. Here is our low-down on how to make payments seamless along with Steps to integrate Netsuite with Stripe

Option 1: Use a plugin written by an in-house developer to Integrate Netsuite with Stripe

Pros:

- Plugin can be customized for slightly complex business workflows

Cons:

- Plugin development and maintenance overhead is huge as a NetSuite developer will have to be hired for this job

- The plugin needs to be maintained forever and using multiple plugins can make the application slow

- NetSuite plugins cannot cater to complex payment workflows and requirements like multi-country payments and payouts.

- Adding new payment methods via plugins is tedious

- Customer payment experience isn’t very seamless due to limitations of Netsuite plugin environment ( for eg: One click payments cannot be built through such plugins

Option 2: Use a plugin provided by the payment processing company (Stripe in this case)

Pros:

- Cheaper than developing and maintaining your own plugin

- Faster deployment

Cons :

- Does not support complex payment workflows

- Expensive as Stripe charges around $2000/month for their plugin

- Cannot be customized

- The payment experience for customers is not that great due to limitations of what netsuite plugins can achieve

Option 3: Use a third party AR software like PayorCRM that provides a seamless payment experience along with reconciliation

PayorCRM is an AR application that helps businesses provide a seamless payment experience while helping manage their cash flows better.

- Supports complex workflows

- No development and maintenance overhead expenses

- Better customer payment experience as it isn’t limited by Netsuite plugin environment limitations.

- Cheaper than Stripe NetSuite plugin ( $2000/month) as well as having an inhouse developer

- Flexibility to use different payment processors based on payment method. e.g.Use Stripe for accepting card payments while using direct bank integration option for ACH

Steps to Integrate Netsuite with Stripe for Credit card payments

If you need to integrate NetSuite with your Stripe account follow these steps –

Step 1: Configure NetSuite

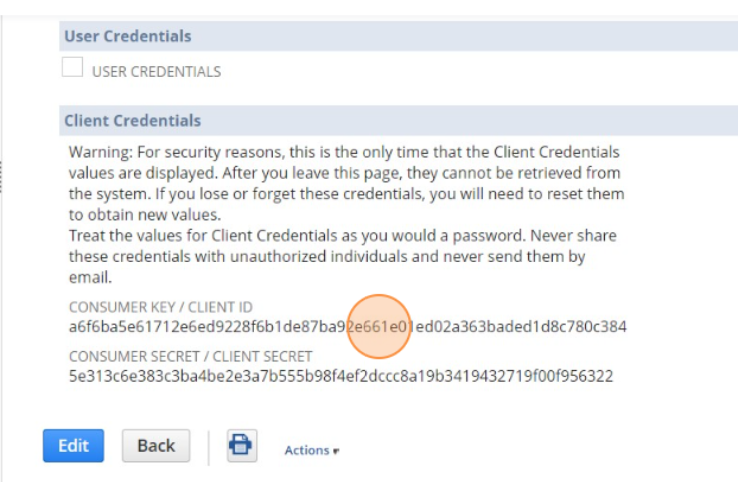

Login to your Netsuite account. Under Setup click on ‘Manage Integrations’ to enable “Token-based authentication”.

Once this is enabled NetSuite will provide a Consumer Key and Consumer Secret. These need to be shared with the PayorCRM Team

Step 2:

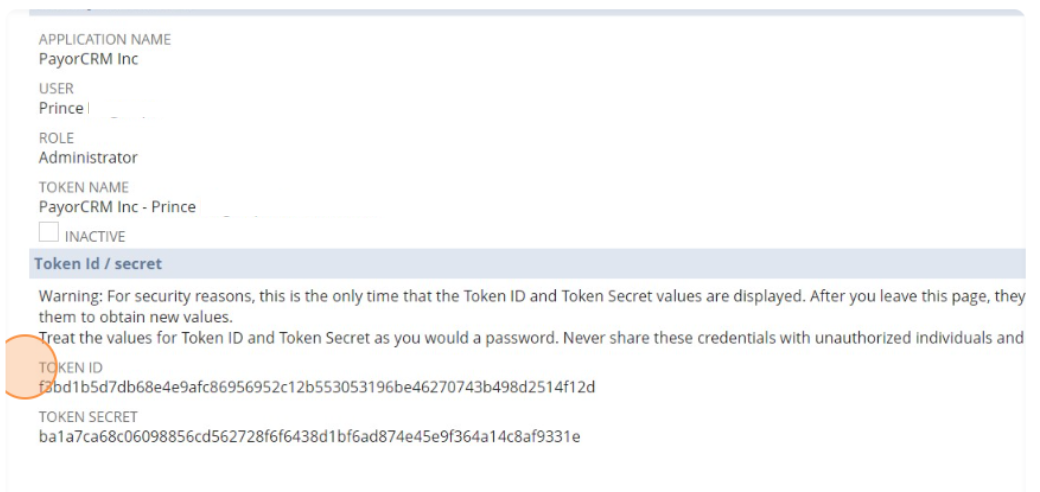

In the NetSuite Dashboard, go to Settings and create a new “Access Token” and “Token Secret” for PayorCRM. Share these with the PayorCRM support team.

Step 3

Add our PDF generation Restlet code to NetSuite.The Restlet code allows Invoice PDFs to be shared with customers through PDF download links on the application. Detailed steps here

Step 4 – Setup Payments with Stripe by configuring secret key

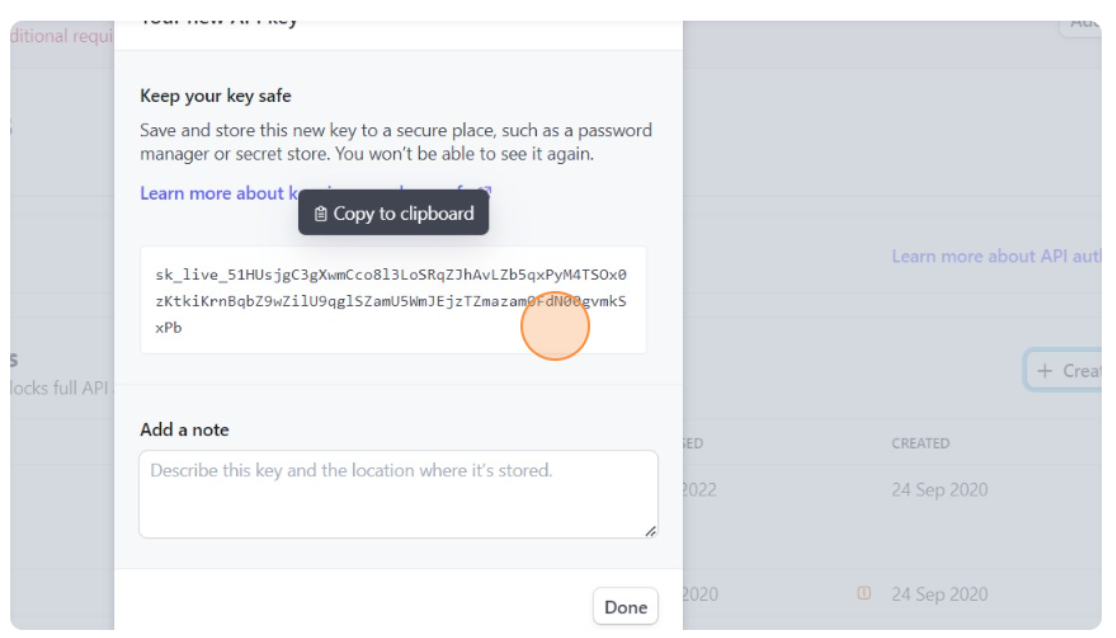

Login to your Stripe Account and navigate to the Stripe Dashboard. Ensure that the Test Mode is switched off. Click on Developers and select APIKeys.

Click on Create secret key by providing a name. Copy the key and share this with the PayorCRM team

Bonus

PayorCRM also offers additional customizations like adding processing fees for credit card transactions and Multi currency payments and multi-country pay-outs for businesses with multiple subsidiaries. Reach out to us for more details

Steps to Integrate Netsuite with Stripe for ACH payments

Stripe supports ACH transfers but the payment experience is limiting. Stripe uses a third party bank verification provider (like Plaid) where customers need to use their credentials to login.

The third party then scrapes the customer bank account details for verifying the customer’s bank account.

This has multiple issues –

- Not all customers would be comfortable with providing their login credentials with third party service providers.

- This option is also an additional overhead as Stripe charges 0.8% (with a cap of $5) for ACH.

- The settlement can take up to a week or more depending on your business risk profile

- Stripe charges higher fees for ACH returns and reversals

PayorCRM has a direct bank integration option to solve this. See more here – https://www.payorcrm.com/ach-payments-using-payment-links-netsuite/

For accepting ACH payments with NetSuite, direct integration with banks is better than through Stripe (another middle man)

- Cheap. Banks charge $0.50 per transaction

- Payments are settled the next day every time

- Standard Return and reversal fees (Stripe adds extra fees over the standard fees)

- Customers are not forced to verify their bank account through a third party that scrapes their bank details

Also published on Medium.