How does ACH work ? What is NACHA ?How are ACH payments relevant for B2B payments

How does ACH work and how it is related to NACHA

NACHA (Automated Clearing House Network) refers to a specific electronic payment network in the US that acts as an intermediary between multiple banks in the US for inter-banking transactions also known as ACH.

NACHA defines the rules and regulation that each of the member banks should follow to maintain the quality of this payment network.

Some of the key attributes of the ACH network are as follows

– The ACH Network or NACHA network is used for business, government and domestic and international consumer payments

– Funds are moved between bank accounts by the banks through the NACHA network

– Payments settle within 1-2 days for “Classic ACH;” payments settle in the same day for “Same Day ACH”

– The Network is governed by NACHA–The Electronic Payments Association

ACH also called Automated clearinghouse is a mechanism where multiple unlinked banks come together to allow its customers to make bank to bank transfers.For eg: you would like to transfer money from your bank account to your friend’s account in BOA.To achieve this using ACH you must first know your friend’s bank account number and also the bank’s routing number

Read more about routing number here

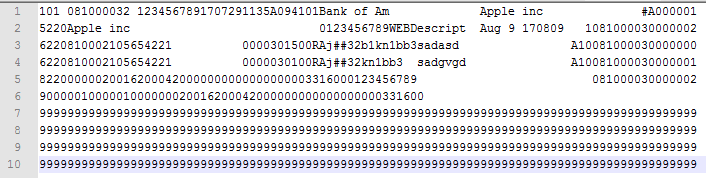

Once you have the routing number details of your friend’s and your own, you may now need to create an ACH file.Below is a sample file generated

AS you can see the file is almost unreadable.This file needs to be uploaded through electronic means to the banks file upload location after which the bank’s software processes the same.In the above lines, 3 and 4 are transaction level data relating to your transaction.In the current example, it would contain your friend’s account number, his routing number and the amount you wish to transfer

Apart from the above there are two ways you could make ACH transactions / ACH payments

How debit ACH payments work

ACH payments could either be a debit transaction or a credit transaction

In a DEBIT ACH payments, the seller “pulls” funds from the customer or buyer’s bank account for

transfer to the seller’s bank account.(Analogy – paying with a check, where the seller then

needs to deposit the check and collect funds.)This sort of transaction is most common in B2B scenarios

How credit ACH payments work

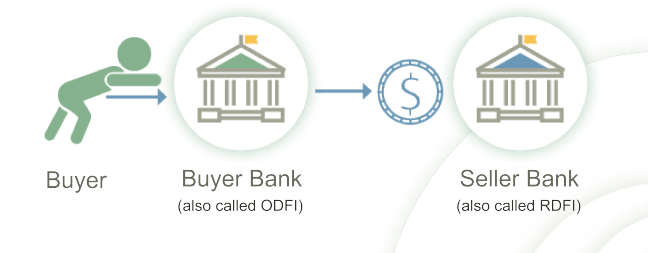

The other would be a credit ACH payment

In a CREDIT ACH payments, the customer or buyer “pushes” funds from the buyer’s bank account to a seller’s bank account.(Analogy – sending a Direct Deposit of payroll to employee – or wire

payment)

Want to enable direct ACH payments for your business? Try the PayorCRM app

If you are a QB Desktop customer visit https://help.payorcrm.com to start using the app. If you are a QB Online customer click here to register

Read more about how ACH payments are relevant when it comes to B2B payments

Contact us to know how your business can accept direct bank payments in US, Canada ,Europe etc

Also published on Medium.