Automated payment reminder work flows and credit customers in QuickBooks

Credit customers in B2B businesses

B2B payments, unlike B2C payments, usually happens on credit.This means that apart from having the downsides of delayed payments the business also has to deal with the additional overhead of follows ups and the additional risk of non-payments.

Having an Automated payment reminder workflow which can follow up customers for soon-to-be-due invoices or overdue invoices will significantly help reduce overheads and delinquency rates in any B2B business working with credit customers

Segments in Automated payment reminder work flows

To come up with a customized email workflow, Initially, You should come up with the segments for each of the automated workflow.

The business can either have a single workflow for all its customers/invoices (single segment) or can choose to have separate workflows for each of the defined segment (multiple segments)

For eg:

Consider a business which has defined their three segments as follows

- Customers with customer numbers ( xxx,yyyy,zzzz etc) [ Long-running important customers]

- Customers excluding customer numbers (xxx,yyyy,zzzz etc) but with invoice amount less than 10,000 USD

- Customers excluding customer numbers (xxx,yyyy,zzzz etc) but with invoice amount greater than or equal to 10,000 USD

Once the segments are defined ,The business will need to come up with automated email workflows for each of the segments as below

Creating Automated payment reminder work flows

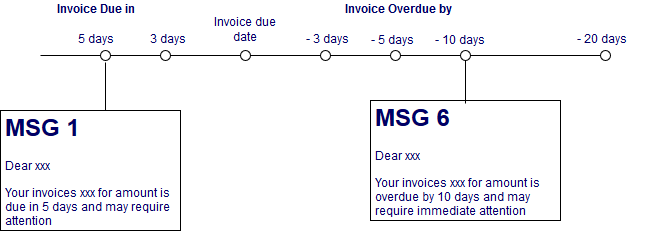

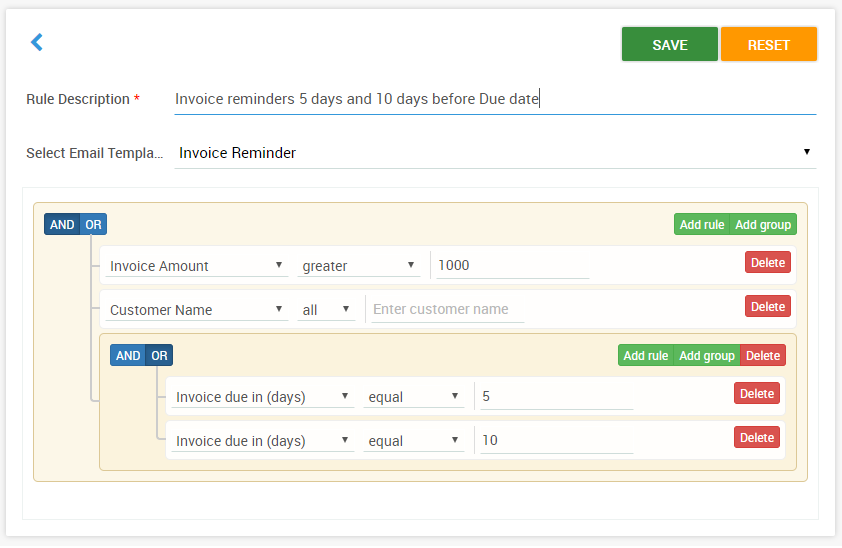

On a paper you could first draw a timeline with days before and after the invoice due date with message content that needs to go in each of those days

The above needs to be done for each of the segments defined by you depending on your business requirements.

Does Automated payment reminder work flows work?

Studies says they do !

The research (link above) talks about a field experiment done with microlenders in Uganda to test the effectiveness of financial incentives vis-a-vis payment reminders.

It was found that simple payment reminders were as effective as financial incentives in ensuring timely loan repayment.

. To put this in numbers timely and regular SMS messages ( which costs almost nothing ) were as effective as 25% reduction in the monthly interest rates (on timely payments) in ensuring timely loan repayments.

To put this into perspective if you had given a loan where the borrower has to pay 1000 USD as monthly EMI (out of which 10% is the interest ).Using electronic reminders (SMS) were as effective as reducing the monthly EMI to 975 USD as an incentive for payment on time. In short, you will be saving 25 USD per month per borrower if you had setup Automated electronic reminders

Is it worth doing ?

As can be seen, by the results of the research, Timely reminders go a long way in getting paid on time and needs to be as automated as possible to avoid manual tasks and consistency.

Advantages

- DSO improvements

- Savings from a reduction of manual effort involved in follow-ups

- Better customer relationships as automated reminders are considered a gentle reminder

Things to consider while selecting such a system

- It should link to your accounting systems (for eg : QuickBooks , Xero etc) and automatically pull invoices and their statuses periodically without any intervention

- It should allow automated emails to be monitored along with responses received from clients. For eg: it should allow your email id to be set in CC so that you can take up any questions your customers have the invoice

- It’s not just important to have an automated system to send reminders.It’s also important to have a mechanism to customize messages, frequency of messages according to the customer and risks involved etc.

- It should allow for message content to be customized (Wordings, fonts etc.)

Some common scenarios that B2B businesses can handle having such an automated email workflow system

- A long-running customer of yours who usually pays on time needn’t require multiple reminders.A simple one-time reminder a few days before the due date may be good enough.

- An invoice with an invoice amount greater than 10,000 USD may require multiple reminders before the due date to ensure timely payment

- A first time customer may require extra reminders to ensure they pay on time. Since they are paying for the first time their systems may not have the complete information of your preferred method of payment. Timely reminders would help accelerate the process

QuickBooks Desktop/Online Customer

If you are

1. A QuickBooks online user – Use the link app.payorcrm.com

2. A QuickBooks desktop user – Check help.payorCRM.com or Reach out to us on [email protected]

PayorCRM is an automated receivable management system that automates most of the Collection related tasks including invoice reminders

Also published on Medium.